AI Automation Case Study: How a Tier-2 NBFC Scaled Operations

How We Built an AI-First Operations Engine for a Tier-2 NBFC

Executive Summary

The financial services landscape is bifurcating. On one side are the digital-native fintech giants, moving with the speed of software. On the other are traditional institutions, often hampered by legacy processes and disconnected systems. This is particularly acute for Tier 2 Non-Banking Financial Companies (NBFCs), which play a critical role in serving the underbanked but often lack the technological firepower to compete on efficiency.

This case study details how Appstudios partnered with a prominent Tier 2 NBFC to fundamentally overhaul their internal operations. Moving beyond simple digitization, we implemented an intelligent, automated ecosystem powered by AI and workflow automation tools like n8n. By connecting offline sourcing, real-time operations, core systems, and advanced AI decisioning, we transformed a fragmented, manual process into a cohesive, high-velocity lending machine.

1. Introduction: The Tier 2 NBFC Dilemma

In the competitive world of lending, speed is currency. For our client, a well-established Tier 2 NBFC, their greatest asset—a vast network of on-ground sourcing agents—was also the source of their most significant operational bottleneck.

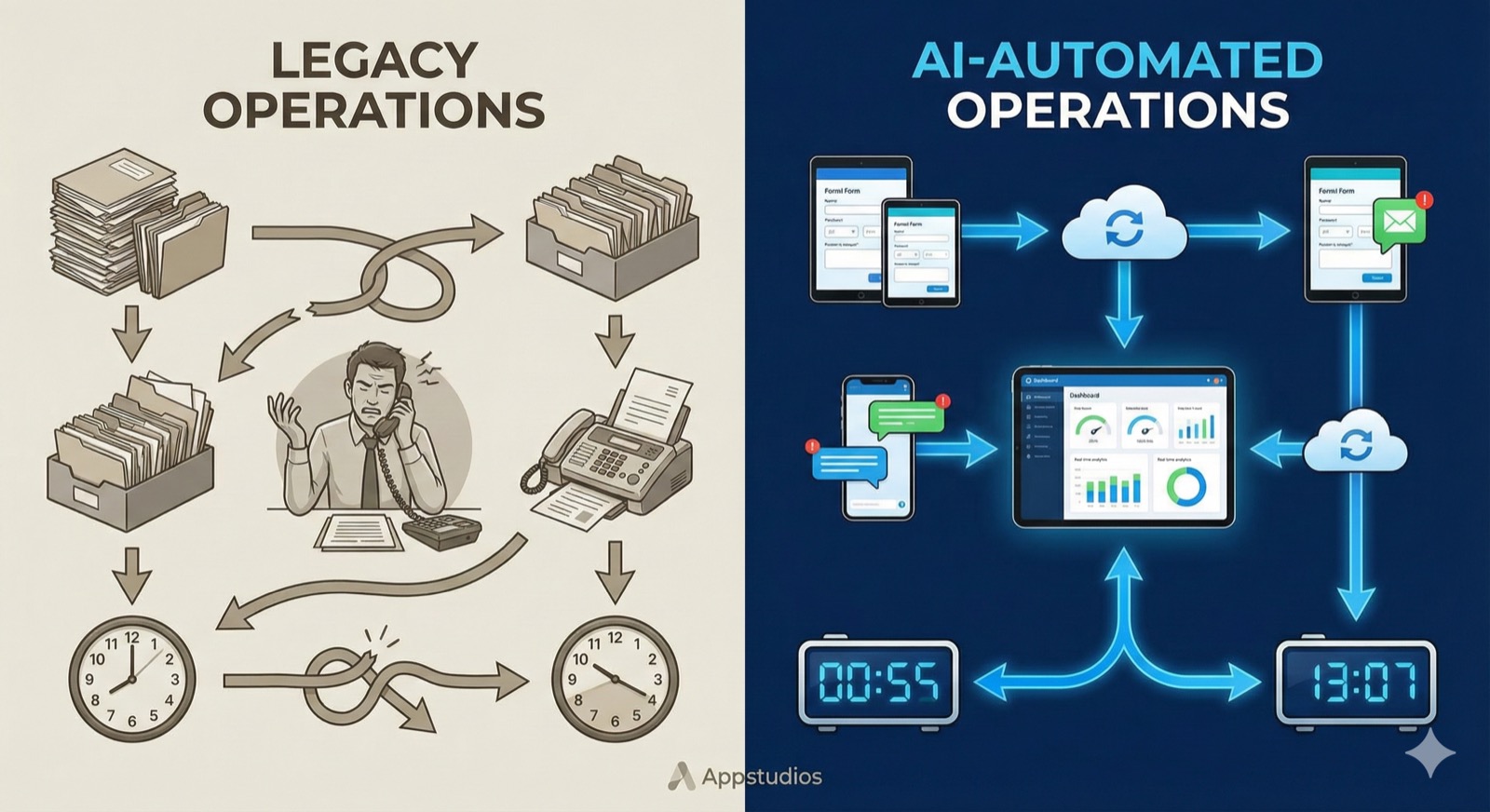

Their process, while functional, was deeply rooted in manual workflows. Agents collected data on paper or via disjointed digital channels. This information had to be manually re-keyed into the Core Loan Origination System (LOS) by back-office teams. Communication was fragmented across emails, phone calls, and spreadsheets, leading to a lack of visibility and high error rates.

The impact was clear:

- High Turnaround Time (TAT): The time from lead acquisition to disbursement was measured in days, not hours.

- Operational Friction: The ops team spent more time chasing data and fixing errors than on value-added tasks.

- Inconsistent Underwriting: Manual credit assessment was slow and subject to human variability.

- Reactive Collections: The collections process was a brute-force effort, lacking the intelligence to prioritize high-risk accounts proactively.

The client recognized that to scale and compete with agile fintech players, they didn’t just need new software; they needed a fundamental rethink of how data and decisions flowed through their organization.

Figure 1: A visual comparison of the client’s legacy, manual operations versus the streamlined, AI-automated future state delivered by Appstudios.

Figure 1: A visual comparison of the client’s legacy, manual operations versus the streamlined, AI-automated future state delivered by Appstudios.

2. The Appstudios Approach: Intelligent Automation as a Service

At Appstudios, we believe that true digital transformation is not about ripping and replacing core systems, which is often risky and cost-prohibitive. Instead, it’s about creating an intelligent “nervous system” that connects existing investments and supercharges them with automation and AI.

For this client, our strategy was built on three pillars:

- Seamless Data Capture: Removing friction at the source.

- Automated Orchestration: Using n8n as the central “glue” to automate workflows across systems.

- AI-Augmented Decisioning: Empowering teams with intelligent insights, not just raw data.

We didn’t just want to make the process digital; we wanted to make it smart.

3. Module 1: The Acquisition Engine (From Field to LOS)

The first step was to fix the “first mile” of the lending journey. The offline agents needed a tool that was as easy to use as a consumer app but powerful enough to capture structured data.

The Easy-to-Operate Form

We deployed a mobile-responsive, simplified digital form for all lead-sourcing agents. This wasn’t just a standard web form; it was designed for speed in the field. It included data validation, auto-population of fields where possible, and easy document upload capabilities.

The Real-Time “Nervous System” on Slack

This is where the magic of automation began. As soon as an agent hit “Submit” on the form, an n8n workflow was triggered.

- Instant Visibility: The internal operations team received a real-time notification on a dedicated Slack channel. The message contained key lead details—customer name, loan amount, product type, and source agent.

- No More “Black Holes”: This simple step eliminated the “where is that file?” problem. The entire ops team had immediate, shared visibility of incoming volume.

Automated Core LOS Punch-In

Simultaneously, the n8n workflow took the structured data from the form and, via API, automatically created a new loan application record in the client’s Core Loan Origination System. This eliminated manual data entry entirely, reducing human error to near zero and saving hours of operational time per day.

4. Module 2: The Intelligent Credit Brain (Automating Underwriting)

With data flowing seamlessly into the LOS, the next bottleneck to tackle was the credit decision process. The client’s existing process was manual and linear, with underwriters reviewing every file from scratch.

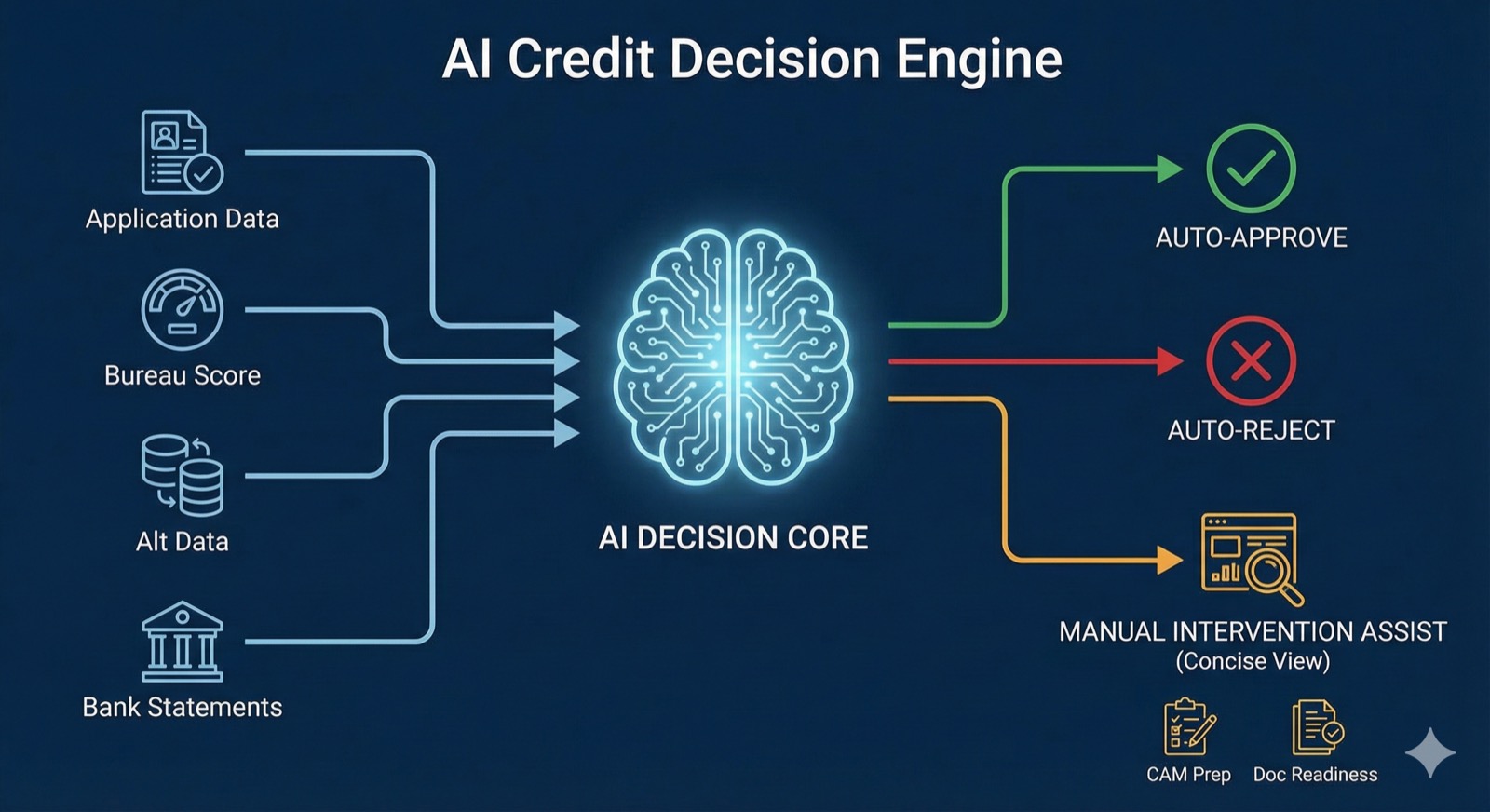

Appstudios implemented an AI-Enabled Credit Policy Engine that automated a significant portion of the decision-making and augmented the rest. We broke the underwriting process down into three distinct outcomes, as illustrated below.

Figure 2: The Appstudios AI Credit Decision Engine, showing data inputs and the three automated outcome paths.

Figure 2: The Appstudios AI Credit Decision Engine, showing data inputs and the three automated outcome paths.

Outcome 1: Automatic Approval (“The Green Channel”)

For low-risk applications that met a predefined set of strict criteria (e.g., high bureau score, stable income, low debt-to-income ratio), the system would instantly issue an approval. This “straight-through processing” (STP) meant that a significant percentage of loans could be approved in seconds without any human intervention.

Outcome 2: Automatic Rejection (“The Red Channel”)

Similarly, applications that fell below hard policy thresholds were automatically rejected. This prevented underwriters from wasting time on applications that would never be approved, allowing them to focus their expertise where it mattered most. The system would also generate a templated rejection letter with the appropriate reasons, ensuring regulatory compliance.

Outcome 3: Manual Intervention Required (“The Amber Channel”)

This is where the system’s intelligence truly shined. For edge cases that were neither a clear “yes” nor a clear “no,” the application was routed to a manual underwriter.

However, the underwriter didn’t start from scratch. The system had already done all the “homework.”

- Concise Data Presentation: The AI engine aggregated data from the application, bureau reports, and alternate data sources, presenting it in a single, easy-to-read dashboard. The underwriter didn’t have to open ten different tabs or sift through a 50-page PDF.

- AI-Powered Analysis: The system included a Bank Statement Analyzer that automatically categorized transactions, identified recurring income and expenses, and flagged potential risks like bounced checks or gambling transactions.

- Automated CAM (Credit Appraisal Memo): A draft CAM was automatically generated, pre-populating key financial ratios and risk scores. The underwriter’s job shifted from data gathering to data analysis and final judgment.

- Document Readiness: All required documents were already indexed and ready for viewing with a single click.

This “AI-assisted” manual review reduced the time taken for complex cases by over 60%, allowing underwriters to handle a much larger volume of applications without compromising on risk assessment quality.

5. Module 3: The Post-Disbursement Lifecycle (Communication & Collections)

The final piece of the puzzle was automating the post-disbursement journey. A loan is a long-term relationship, and managing it manually is impossible at scale.

The Automated Communication Stack

We built a comprehensive communication workflow that was triggered by various events in the loan lifecycle.

- Welcome Kit: Upon disbursement, a welcome email and SMS with loan details, repayment schedule, and access to a customer portal were sent automatically.

- Payment Reminders: Automated reminders were scheduled to be sent a few days before each EMI due date, reducing accidental delinquencies.

- KYC Refresh: For longer-tenure loans, the system automatically triggered requests for updated KYC documents at required intervals.

AI-Enabled Collections Engine

Moving beyond simple reminders, the collections process was supercharged with AI.

- Early Warning Signals (EWS): The AI model analyzed borrower behavior—such as a sudden change in spending patterns (if bank data was available) or a slight delay in a previous payment—to identify customers at risk of default before they missed a payment.

- Intelligent Prioritization: Instead of calling customers alphabetically, the collections team was provided with a prioritized list of high-risk accounts every morning.

- Next Best Action: The system suggested the most effective communication channel and tone for each customer (e.g., a gentle SMS reminder for a first-time late payer vs. a phone call for a repeat offender).

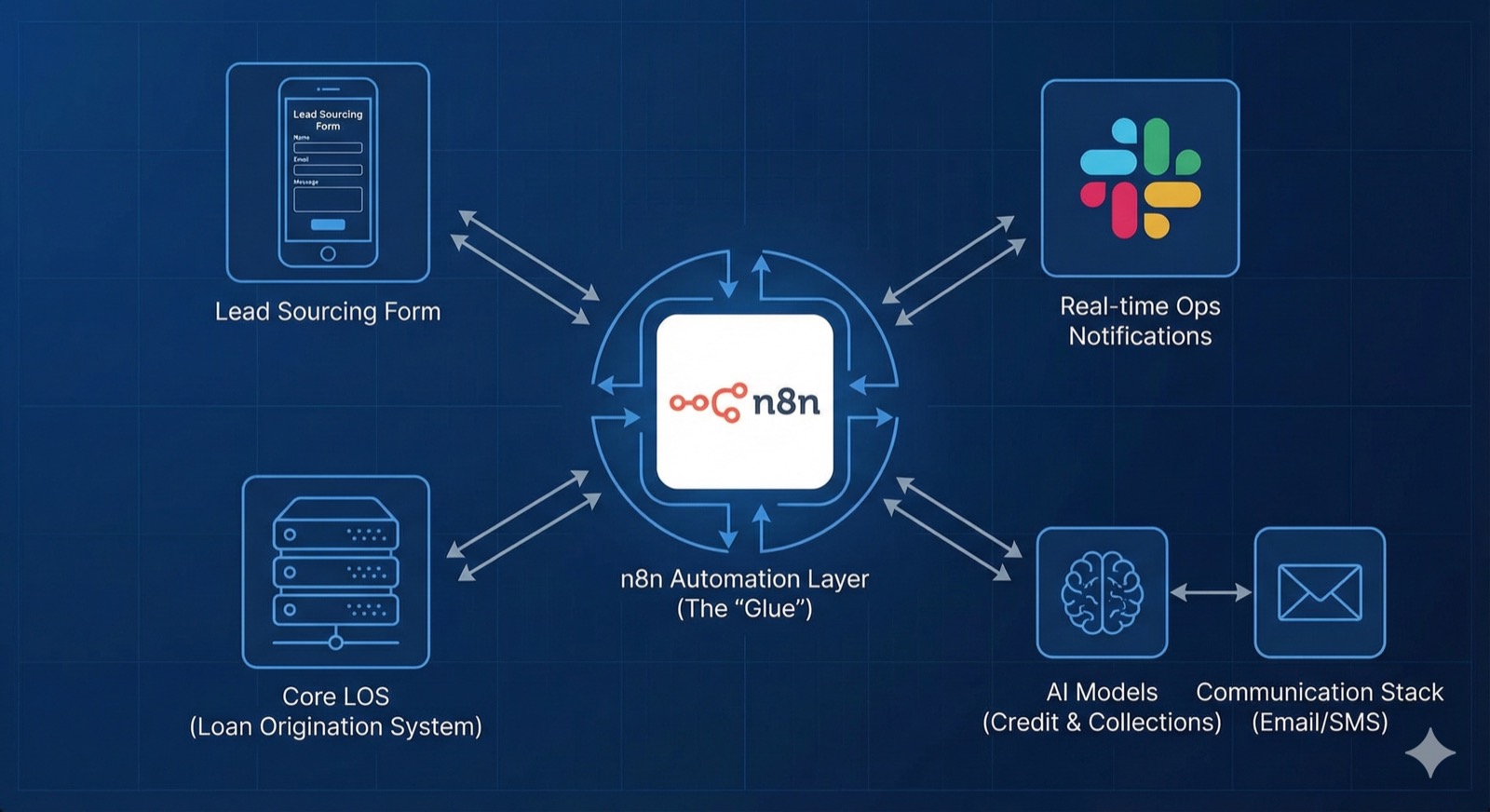

6. The Technology Stack Under the Hood: Why n8n?

The success of this project relied on choosing the right tools. At the heart of our solution was n8n, a powerful workflow automation tool.

Figure 3: The high-level technical architecture, with n8n acting as the central automation hub connecting all systems.

Figure 3: The high-level technical architecture, with n8n acting as the central automation hub connecting all systems.

We chose n8n for several key reasons:

- Flexibility: It can connect to almost any system with an API, allowing us to integrate the new lead form, Slack, the Core LOS, AI models, and email/SMS services without building custom point-to-point integrations.

- Visual Workflow Builder: This allowed us to design complex workflows visually, making it easy for the client’s IT team to understand and maintain the system after handover.

- Scalability: n8n is built to handle high volumes of data and triggers, ensuring the system can grow with the client’s business.

By using n8n as the “glue,” we created a modular, future-proof architecture that is not dependent on a single monolithic software vendor.

7. Results and Impact: A Quantum Leap in Efficiency

The transformation was not just technical; it had a profound impact on the client’s business metrics.

- TAT Reduction: The average time from lead sourcing to disbursement was reduced by over 70%, moving from days to hours.

- Operational Efficiency: The back-office operations team saw a 50% reduction in manual workload, allowing them to be redeployed to higher-value tasks like customer service and complex query resolution.

- Improved Credit Quality: The AI-assisted underwriting process led to more consistent credit decisions, with early indicators showing a potential 15% reduction in non-performing assets (NPAs).

- Enhanced Customer Experience: Borrowers received faster decisions, transparent communication, and a seamless digital journey, leading to higher customer satisfaction scores.

- Scalability: The system can now handle a 3x increase in loan volume without a proportional increase in headcount.

8. Conclusion: The Future of Lending is Intelligent Automation

This case study demonstrates that Tier 2 NBFCs do not have to be left behind in the digital race. By embracing intelligent automation and AI, they can leapfrog legacy constraints and build operations that are faster, smarter, and more efficient than ever before.

At Appstudios, we don’t just build software; we build intelligent operational ecosystems that drive real business value. We help our clients move beyond the hype of AI and automation to implement practical, scalable solutions that solve their most pressing challenges.

Explore how AI-led automation can transform your business and partner with us to build your future.

Contact Appstudios today for a consultation.